Unknown Facts About Palau Chamber Of Commerce

Table of ContentsThe smart Trick of Palau Chamber Of Commerce That Nobody is Talking AboutThe smart Trick of Palau Chamber Of Commerce That Nobody is DiscussingGetting My Palau Chamber Of Commerce To WorkThings about Palau Chamber Of CommerceThe 10-Second Trick For Palau Chamber Of CommerceSome Known Questions About Palau Chamber Of Commerce.The Greatest Guide To Palau Chamber Of CommerceThe Facts About Palau Chamber Of Commerce Revealed

contribution size, when the contribution was made, who contributed, how much, how they involved your web site, and so on) Finally, contribution web pages make it convenient as well as basic for your contributors to give! 8. 3 Produce an advertising and marketing and also web content plan It can be alluring to allow your advertising create organically, however doing so offers more problems than benefits.

Be sure to collect e-mail addresses as well as other pertinent data in a correct means from the beginning. 5 Take care of your individuals If you have not tackled working with and also onboarding yet, no worries; currently is the time.

There are numerous contribution software application out there, and also not using one can make on the internet fundraising rather inefficient or also impossible.

Not known Facts About Palau Chamber Of Commerce

To read more, look into our post that talks more comprehensive concerning the main nonprofit funding resources. 9. 7 Crowdfunding Crowdfunding has actually turned into one of the essential means to fundraise in 2021. Because of this, not-for-profit crowdfunding is grabbing the eyeballs nowadays. It can be utilized for certain programs within the organization or a general donation to the reason.

During this action, you could desire to believe about milestones that will certainly suggest a possibility to scale your not-for-profit. As soon as you have actually run for a bit, it's essential to take some time to think concerning concrete growth goals.

Facts About Palau Chamber Of Commerce Revealed

Without them, it will be hard to evaluate as well as track progress later on as you will certainly have nothing to gauge your results against as well as you won't recognize what 'successful' is to your not-for-profit. Resources on Beginning a Nonprofit in different states in the US: Starting a Not-for-profit Frequently Asked Questions 1 - Palau Chamber of Commerce. Just how much does it set you back to begin a nonprofit company? You can start a not-for-profit company with a financial investment of $750 at a bare minimum and it can go as high as $2000.

How much time does it take to establish a not-for-profit? Depending upon the state that you remain in, having Articles of Incorporation authorized by the state government may take up to a few weeks. Once that's done, you'll have to request recognition of its 501(c)( 3) standing by the Irs.

With the 1023-EZ form, the processing time is commonly 2-3 weeks. Can you be an LLC and a not-for-profit? LLC can exist as a not-for-profit minimal responsibility business, nonetheless, it needs to be entirely had by a single tax-exempt nonprofit organization.

3 Easy Facts About Palau Chamber Of Commerce Described

What is the difference in between a foundation as well as a not-for-profit? Structures are normally moneyed by a household or a business entity, yet nonprofits are moneyed with their revenues as well as fundraising. Foundations normally take the cash they began with, invest it, and afterwards disperse the cash made from those financial investments.

Whereas, the added money a not-for-profit makes are utilized as running prices to fund the organization's mission. Is it difficult to start a nonprofit organization?

Although there are numerous steps to start a nonprofit, the obstacles to access are reasonably couple of. 7. Do try these out nonprofits pay taxes? Nonprofits are excluded from government revenue tax obligations under section 501(C) of the internal revenue service. Nonetheless, there are specific conditions where they might require to make payments. If your nonprofit makes any earnings from unconnected tasks, it will owe income tax obligations on that amount.

About Palau Chamber Of Commerce

The role of a not-for-profit organization has actually always been to develop social change as well as lead the method to a much better world., we focus on options that he has a good point assist our nonprofits increase their contributions.

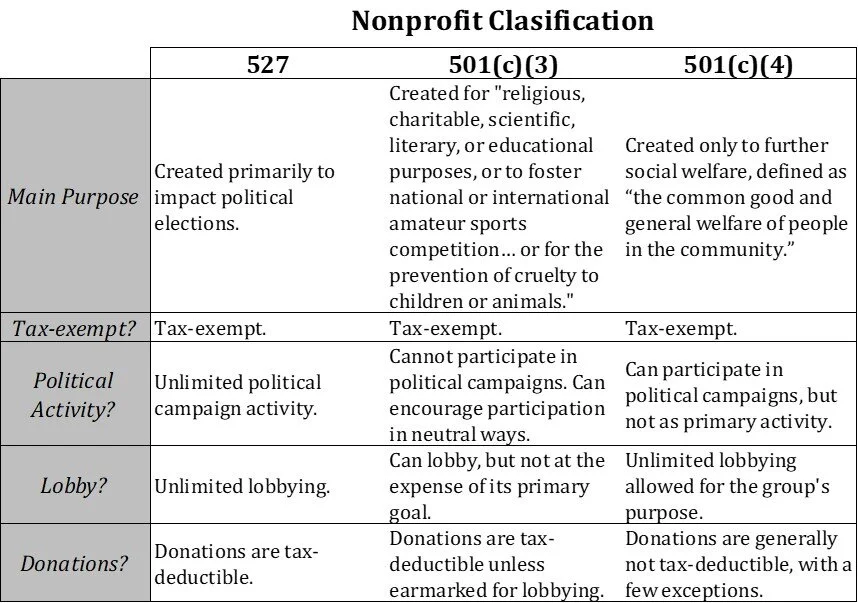

Twenty-eight different kinds of not-for-profit organizations are acknowledged by the tax obligation legislation. However by far one of the most common sort of nonprofits are Section 501(c)( 3) organizations; (Section 501(c)( 3) is the part of the tax code that accredits such nonprofits). These are nonprofits whose mission is charitable, religious, academic, or clinical. Section 501(c)( 3) company have one massive benefit over all various other nonprofits: contributions made to them are tax obligation insurance deductible by the donor.

This category is necessary due to the fact that private structures undergo rigorous operating rules as well as laws that don't use to public sites charities. As an example, deductibility of payments to a personal foundation is much more minimal than for a public charity, and exclusive structures go through excise taxes that are not enforced on public charities.

Fascination About Palau Chamber Of Commerce

The lower line is that personal foundations get much even worse tax therapy than public charities. The major difference in between personal foundations as well as public charities is where they obtain their financial backing. A personal foundation is commonly regulated by a private, household, or firm, as well as acquires many of its income from a couple of benefactors as well as investments-- an excellent example is the Bill as well as Melinda Gates Foundation.

The majority of structures simply give cash to various other nonprofits. As an useful matter, you require at the very least $1 million to start a personal foundation; or else, it's not worth the problem as well as cost.

Various other nonprofits are not so lucky. The IRS originally assumes that they are personal foundations. Palau Chamber of Commerce. Nevertheless, a brand-new 501(c)( 3) company will certainly be categorized as a public charity (not an exclusive structure) when it requests tax-exempt standing if it can reveal that it sensibly can be anticipated to be openly supported.

The Best Guide To Palau Chamber Of Commerce

If the IRS identifies the nonprofit as a public charity, it keeps this condition for its very first 5 years, despite the public assistance it actually gets throughout this time around. Beginning with the nonprofit's sixth tax obligation year, it needs to show that it fulfills the general public assistance test, which is based upon the support it gets during the existing year as well as previous 4 years.